Tax In North Carolina 2025

Tax In North Carolina 2025. Effective for taxable years beginning on or after january 1, 2025, and applicable to the calculation of franchise tax reported on the 2025 and later corporate. Free tool to calculate your hourly and salary income.

Effective for taxable years beginning on or after january 1, 2025, and applicable to the calculation of franchise tax reported on the 2025 and later corporate. The tax rate decreases to 4.5%, instead of 4.75%, the.

The north carolina tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in north carolina, the calculator allows you to calculate.

2025 State Tax Rates and Brackets Tax Foundation, The north carolina tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in north carolina, the calculator allows you to calculate. The average effective property tax rate for the state is below the national average.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, North carolina's 2025 income tax brackets and tax rates, plus a north carolina income tax calculator. 829 rows combined with the state sales tax, the highest sales tax rate in north carolina is 7.5% in the cities of durham, durham, chapel hill, wake forest and durham (and fourteen other cities).

20k Salary After Tax in North Carolina US Tax 2025, North carolina law gradually reduces personal income tax rates starting in 2025 under hb 259 , enacted on october 3, 2025, without the signature of governor. Income tax tables and other tax information is sourced from the north.

Nc State Tax Forms Printable, North carolina’s flat tax rate will decrease in 2025, the state revenue department said dec. Explore the north carolina budget.

43.369k Salary After Tax in North Carolina US Tax 2025, There is a statewide sales tax and each county levies an. The 2025 tax rates and thresholds for both the north carolina state tax tables and federal tax tables are comprehensively integrated into the north carolina tax calculator for.

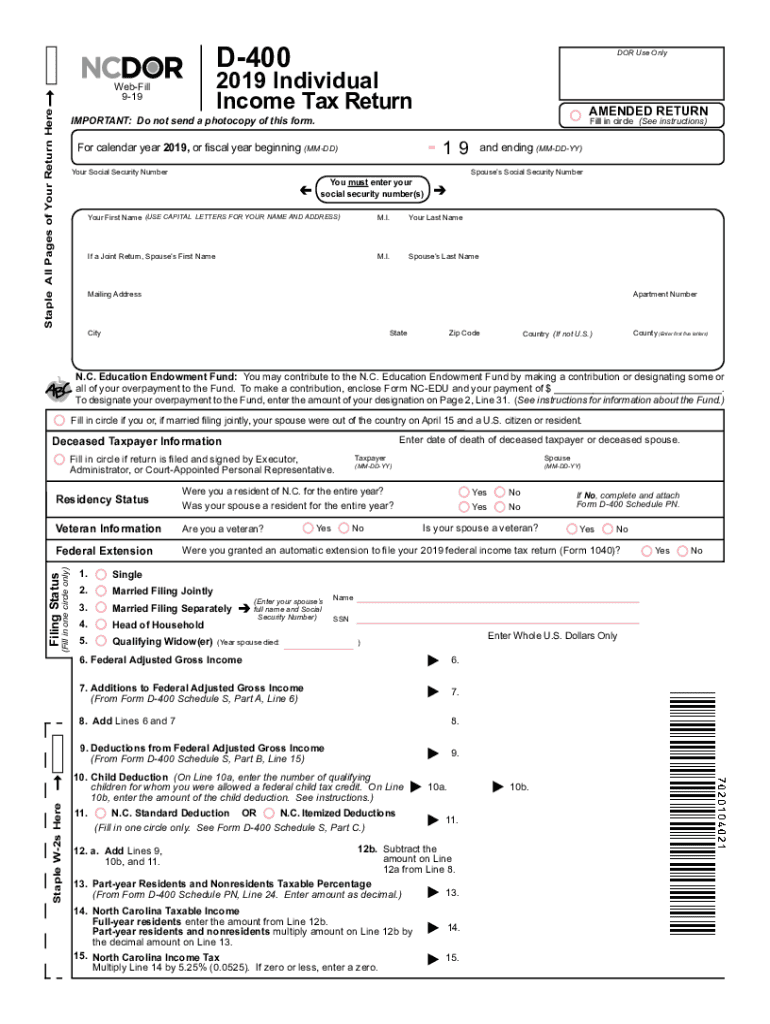

Nc D400 20192024 Form Fill Out and Sign Printable PDF Template, Today, the north carolina department of revenue officially opened the 2025 individual income tax season and began accepting 2025 returns. Discover the north carolina capital gains tax and its rates in 2025.

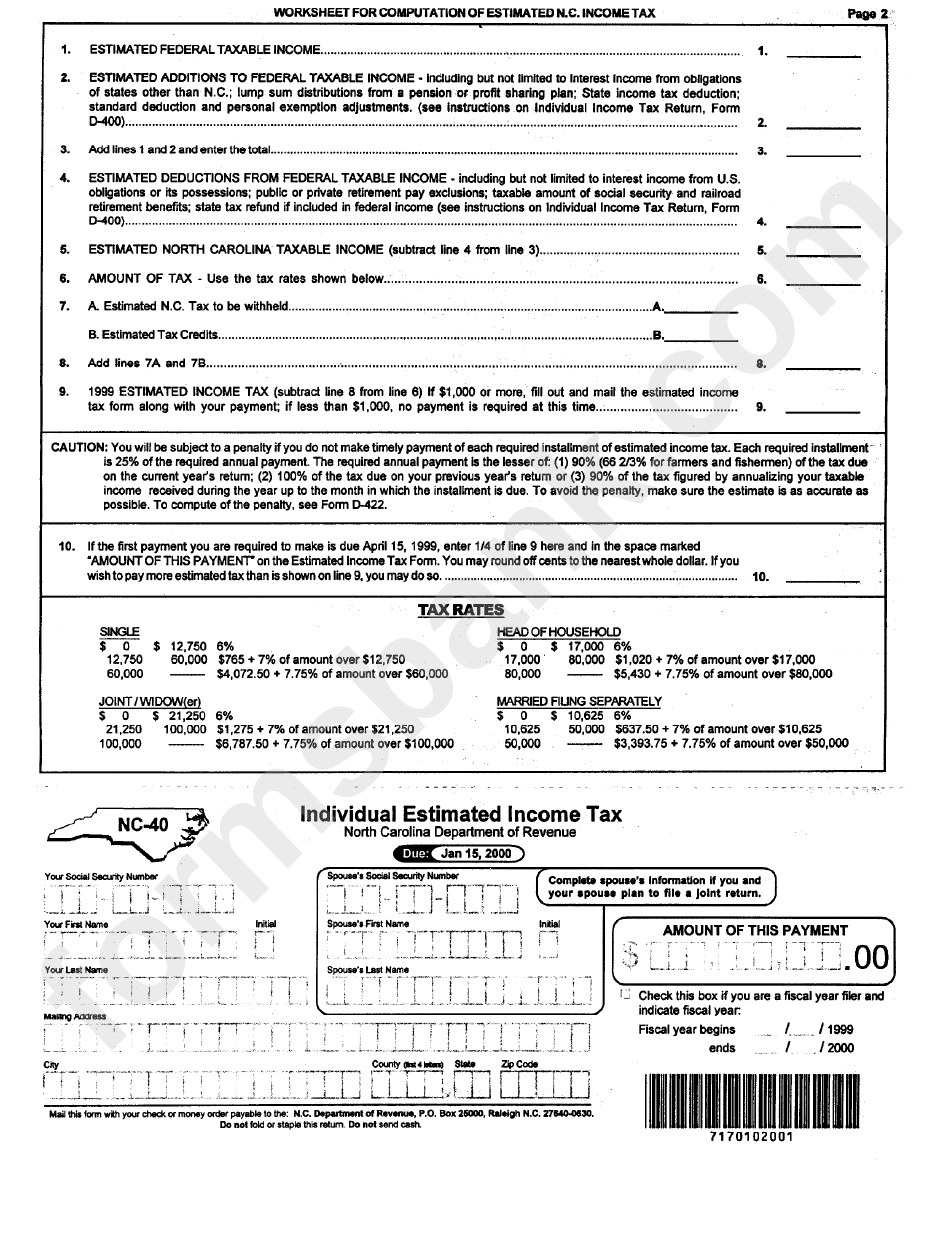

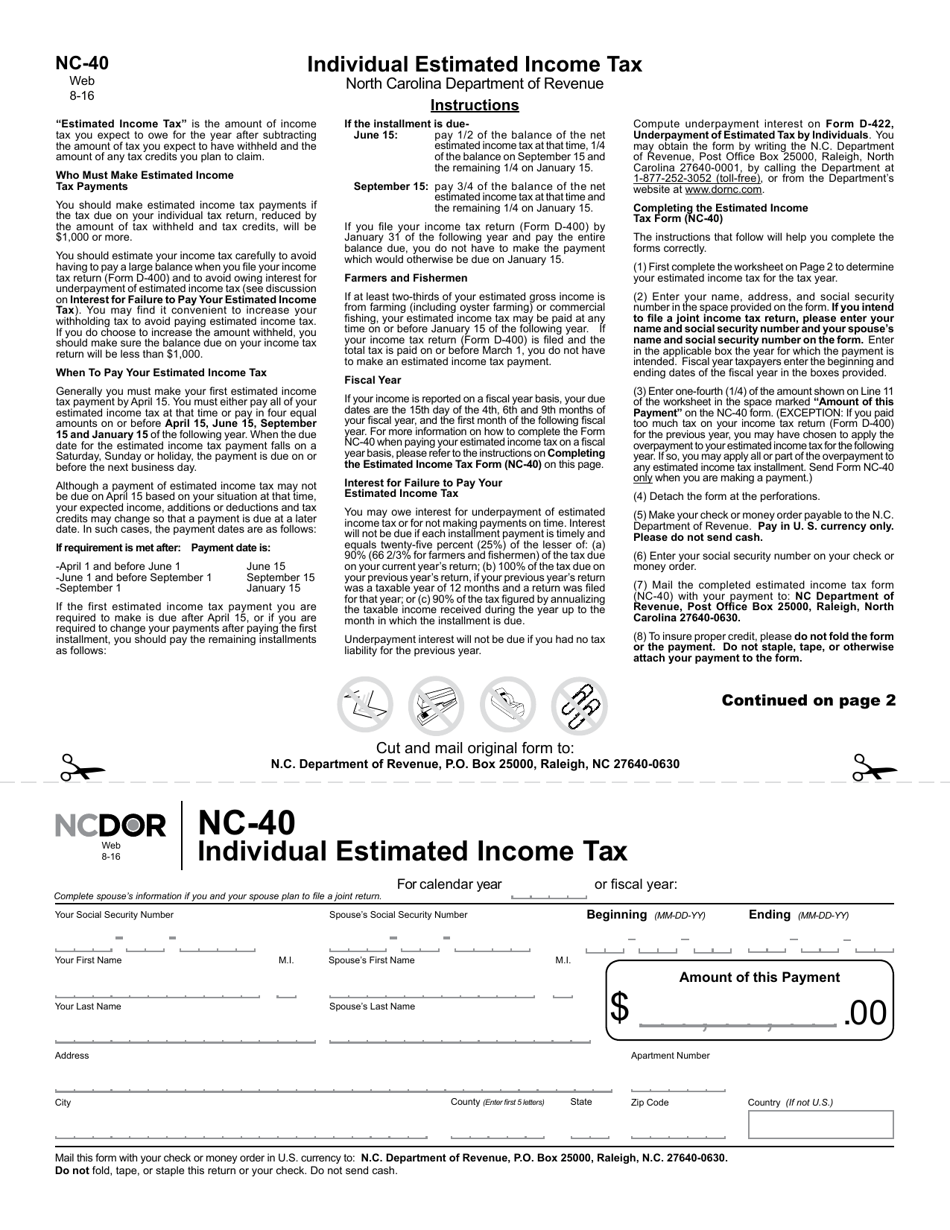

Form NC40 Fill Out, Sign Online and Download Printable PDF, North, Under recent tax changes, north carolina’s individual income tax rate will decrease every year until it reaches 3.99 percent for tax year 2026. Discover the north carolina capital gains tax and its rates in 2025.

28k Salary After Tax in North Carolina US Tax 2025, The rate for tax year. 829 rows combined with the state sales tax, the highest sales tax rate in north carolina is 7.5% in the cities of durham, durham, chapel hill, wake forest and durham (and fourteen other cities).

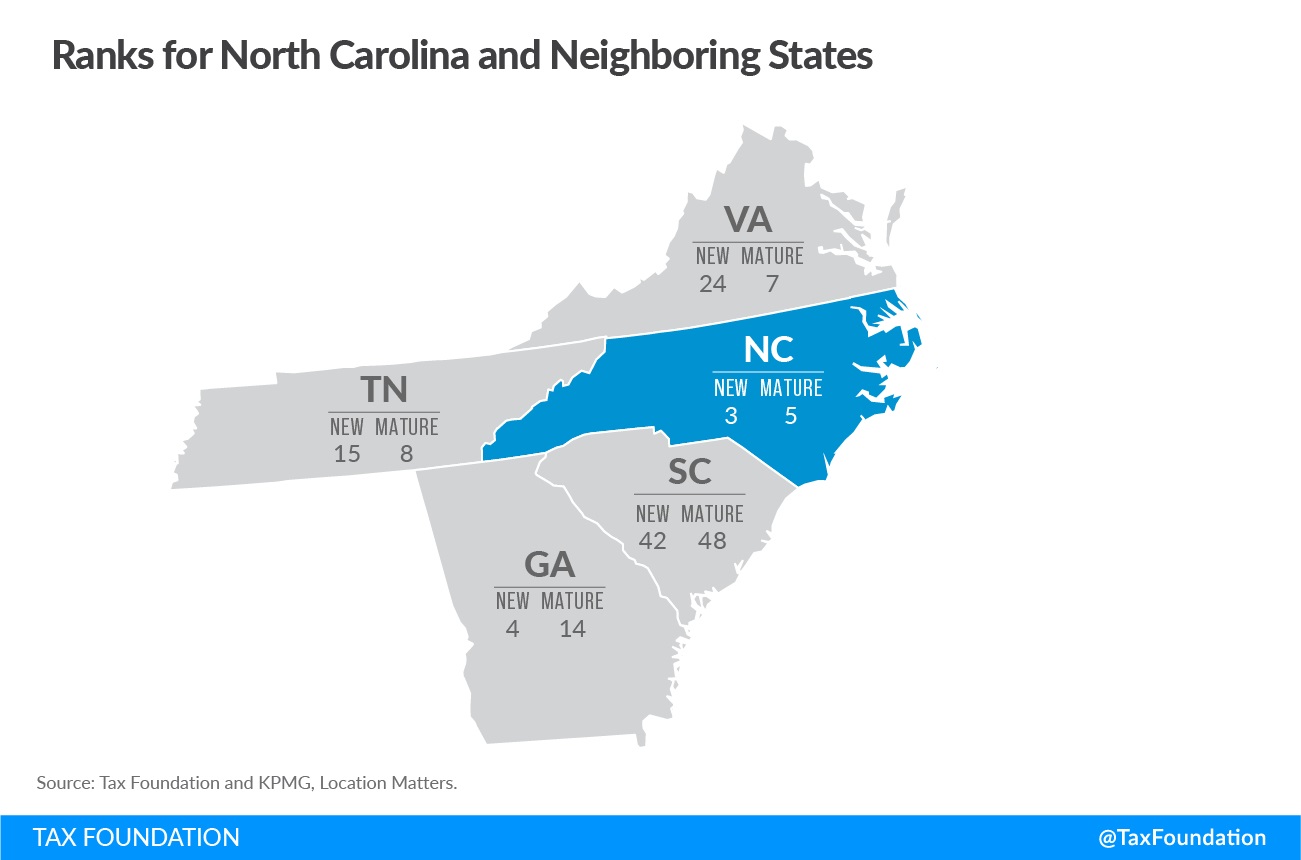

NC Ranks Among Most Competitive Tax Structures for Businesses, Learn some tax planning strategies to reduce your capital gains taxes. North carolina’s flat tax rate will decrease in 2025, the state revenue department said dec.

816.84k Salary After Tax in North Carolina US Tax 2025, There is a statewide sales tax and each county levies an. North carolina annual bonus tax calculator 2025, use icalculator™ us to instantly calculate your salary increase in 2025 with the latest north carolina tax tables.

Effective for taxable years beginning on or after january 1, 2025, and applicable to the calculation of franchise tax reported on the 2025 and later corporate.